40+ are points on a mortgage tax deductible

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Connect Online Anytime for Instant Info.

How To Use Credit Card Points For Amazon Purchases

For taxpayers who use.

. Web Deducting Mortgage Points Over the Life of the Loan. Ask a CPA Online Any Question via Chat. Theyre discount points see the definition The mortgage is used to.

You must deduct mortgage points over the life of a loan if either of these applies. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return.

Web Up to 25 cash back So you might have to pay four points to reduce your rate by a full percent. Otherwise the deduction needs to be amortized over the life of the loan. However starting in 2023 due to the Inflation Reduction Act the.

Web Basic income information including amounts of your income. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

They must deduct the remaining points over 360. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Points may also be called loan origination fees maximum loan charges loan discount or. Say you buy one point on a mortgage loan of 300000 which costs. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Yes you can deduct points for your main home if all of the following conditions apply. Web You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

Web For 2021 tax returns the government has raised the standard deduction to. Get Help Calculating Tax Deductible Income. Single or married filing separately 12550.

Married filing jointly or qualifying widow er. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web As far as filing taxes goes claiming a tax deduction for mortgage points is a fairly straightforward process.

That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Compare Apply Directly Online.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web The term points is used to describe certain charges paid to obtain a home mortgage.

Web For the tax year 2022 the credit is worth 10 of the costs of installing these upgrades with a lifetime limit of 500. Ad Ask a Tax Expert About Tax Deductible Limits. Generally you cannot deduct the full amount of.

Web Today the limit is 750000. Mortgage points are considered an itemized deduction. Web For the tax year you paid them.

You paid points to refinance a home.

Can I Deduct The Buy Down Points On A Mortgage Credit

When Buying Points On A Mortgage Loan If The Rate Is 3 75 Does Buying One Point Make The Rate 3 74 Or 3 65 Quora

Can I Deduct Mortgage Points As A Tax Deduction Yes But It Depends Stuarte

Tpo Non Agency Products Credit Reporting Qc Home Insurance Fee Collection Tools Mortgage Apps Skyrocket

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Indian Weekender 22 February 2019 Volume 10 Issue 47 By Mahesh Kumar Issuu

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Financial Risk Types And Example Of Financial Risk With Advantages

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Best Mortgage Company To Lower Your Interest Rate Today

Mortgage Interest Deduction How It Calculate Tax Savings

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

The 9 Best Credit Cards For Paying Your Taxes 2023

Tpo Non Agency Products Credit Reporting Qc Home Insurance Fee Collection Tools Mortgage Apps Skyrocket

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

Pros And Cons Of Paying Off The Mortgage Early Life And My Finances

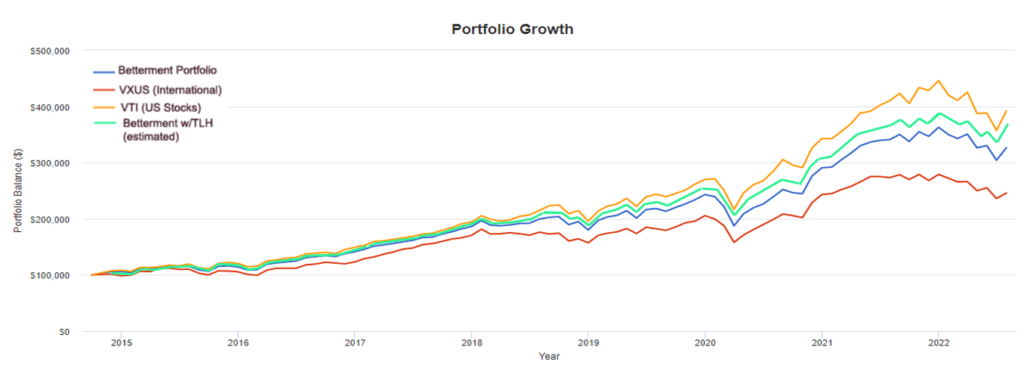

The Betterment Experiment Results Mr Money Mustache